Delivering net zero with hydrogen: The key to an integrated and secure energy system

4 May 2023Reaching Ireland’s green hydrogen potential

4 May 2023EU pushing hydrogen development

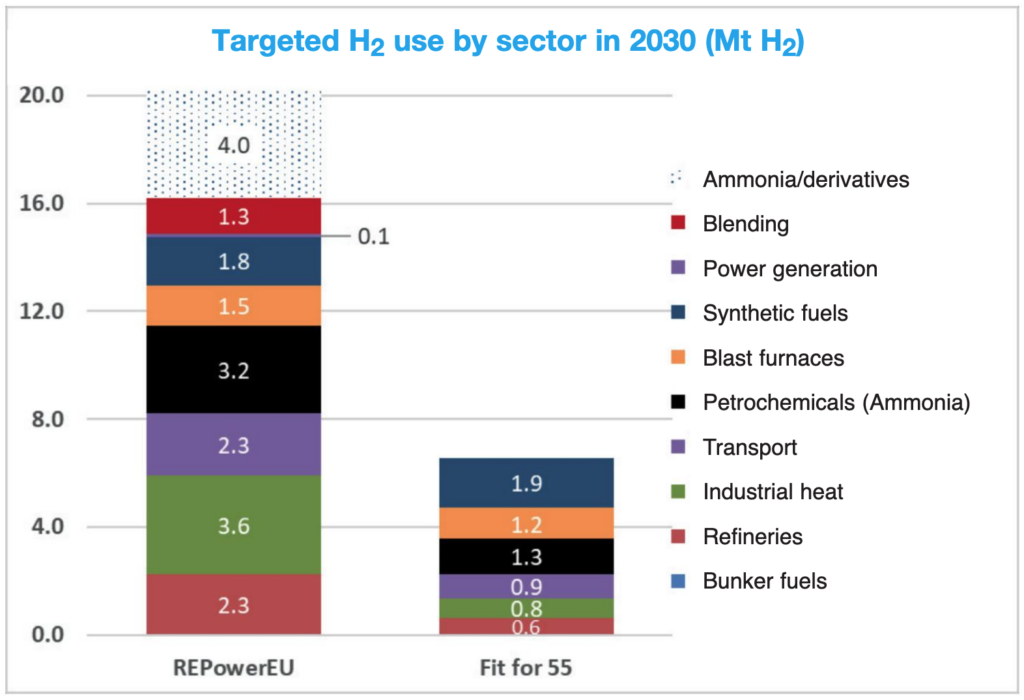

As part of the EU’s push to reduce reliance on Russian oil and gas imports, the REPowerEU plan has set a European target of 10 million tonnes of domestic renewable hydrogen production by 2030, to be complemented by a further 10 million tonnes of renewable hydrogen imports.

Although an EU-wide target has been set, the responsibility for member states is to set their own hydrogen strategies. Therefore, this target does not delegate a level which must be reached by each respective member state.

In order to achieve the target of domestic renewable hydrogen production foreseen in REPowerEU, total investment needs are estimated at between €335 billion and €471 billion, including between €200 billion and €300 billion needed for additional renewable energy production. The vast majority of this will come from private funding, but public funding (through the EU financial instruments and state aid) can play an important role in pump priming so as to increase the ability in leveraging private investment, especially in the initial stages of establishing a European hydrogen market.

With the level of required funding in mind, on 16 March 2023, the European Commission announced plans to establish a European Hydrogen Bank (EHB). The Commission is intending for the EHB to cover and lower the cost gap between renewable hydrogen and fossil fuels for early projects. The Commission hopes to achieve this by the establishment of an auction system for renewable hydrogen production to support producers through a fixed price payment per kilogramme of hydrogen produced for a maximum of 10 years of operation.

The first pilot auctions are currently being designed and they are due to be launched in autumn 2023, backed by €800 million from the Innovation Fund. The bank will create an EU auction platform offering “auctions-as-a-service” for member states, using both Innovation Fund and member state resources to fund renewable hydrogen projects without prejudice to EU state aid rules.

Another central focus of the EU hydrogen strategy is the doubling of the number of hydrogen valleys in the EU by 2025, with Ireland’s first hydrogen valley currently being created off the coast of Galway. At the time of the publication of REPowerEU, there were 23 hydrogen valleys in the EU. This number is now 25, with an additional two in the United Kingdom.

Beyond using renewable hydrogen in industry and transport, it is necessary to look at other sectors where hydrogen uptake could be increased without causing harm. The Commission has stated that blending hydrogen into the natural gas grid requires “careful consideration as it diminishes gas quality,” adding that it “can increase overall system costs and the costs of heating for the residential sector, and it is in most applications a less efficient alternative to direct electrification”.

Blending up to around 3 per cent by volume of renewable hydrogen in the gas grid may absorb about 1.3 million tonnes of hydrogen and replace 4.7 bcm natural gas. However, this will require considering all consequences and costs of blending, including overall system costs and adaptation costs for household and industrial end users. For example, the costs for end-users and infrastructure operators to adapt to a 5 per cent blending level (by volume) would amount to around €3.6 billion per year.

Development of a State hydrogen strategy

Currently, Ireland’s hydrogen strategy is being developed, with consultations being reviewed as of April 2023. A hydrogen strategy is a key development goal and is being done under the aegis of Climate Action Plan 2021, which itself is heavily influenced by the European Green Deal.

In Ireland, the development of a hydrogen strategy is one of the key priorities in the plans outlined in the National Energy Security Framework, which aims to ensure the affordability and sustainability of Ireland’s energy supply.

This prospective hydrogen strategy is set in the context of three prongs of EU hydrogen development:

- From the present to 2024, the EU will support the installation of at least 6GW of renewable hydrogen electrolysers, and the production of up to 1 million tonnes of renewable hydrogen across member states.

- From 2025 to 2030, it recognises that hydrogen needs to become an intrinsic part of an integrated energy system, with at least 40GW of renewable hydrogen electrolysers and the production of up to 10 million tonnes of renewable hydrogen in the EU.

- From 2030 onwards, it sets out that renewable hydrogen will be deployed at a large scale across all hard-to-decarbonise sectors.

The State hydrogen strategy is due for publication before summer 2023. With Climate Action Plan 2023 already earmarking 2GW of offshore wind development for the development of green hydrogen, it is expected that the sector will see significant expansion, particularly for transitioning Ireland’s car-reliant transport system. Ireland’s location makes it an important asset for the EU and, if successful in its hydrogen endeavours, could make the State among the most influential energy producers in Europe.